In today's fast-paced business environment, efficiency is paramount. Companies are constantly seeking ways to enhance operational procedures. One area where significant gains can be realized is in collections. By leveraging the power of AI automation, organizations can optimize their collections processes, resulting in faster payment cycles and reduced delinquency rates.

AI-powered solutions offer a range of capabilities that revolutionize the collections landscape. For example, intelligent chatbots can handle initial customer communications regarding overdue payments, disengaging valuable human resources for more challenging cases.

, Moreover, machine learning algorithms can analyze vast pools of information to predict the likelihood of payment defaults. This allows organizations to proactively address potential risks and execute targeted strategies for recovery.

- , Consequently, AI automation in collections empowers organizations to attain remarkable improvements in efficiency, output, and financial results.

Smart Debt Collection

The landscape of debt recovery is undergoing a dramatic/significant/rapid transformation, driven by the increasing/growing/emerging adoption of intelligent/smart/advanced technologies. This shift towards intelligent debt recovery promises to revolutionize/modernize/streamline the collections process, benefiting/helping/assisting both creditors and debtors alike.

Sophisticated/Cutting-edge/Advanced algorithms and machine learning are being utilized/employed/implemented to analyze/evaluate/assess vast datasets/pools of information/troves of data, enabling more accurate/precise/targeted risk assessments and personalized/tailored/customized collection strategies. This data-driven/analytics-based/information-powered approach allows creditors to optimize/enhance/improve their recovery rates/success/performance while minimizing/reducing/lowering the impact on debtor relationships/experiences/interactions.

Furthermore, intelligent debt recovery systems can automate/streamline/simplify many manual tasks, such as sending/disbursing/delivering reminders and processing payments, freeing up valuable time/resources/staff for more complex/strategic/critical initiatives. This increased efficiency/productivity/output not only reduces/lowers/minimizes costs but also improves/enhances/strengthens the overall customer service/debtor experience/collections process.

The future of debt recovery is undoubtedly intelligent, and those who embrace/adopt/integrate these innovative/progressive/forward-thinking technologies are well-positioned/set to succeed/likely to thrive.

Elevating Debt Collection with AI Technology

The debt collection industry is on the cusp of a radical transformation, driven by the innovative capabilities of artificial intelligence (AI). AI-powered solutions are reshaping the landscape by optimizing key processes and enhancing the overall efficiency and effectiveness of debt collection.

Among of the most impactful applications of AI in this sector is in automated collections. By analyzing vast troves of data, AI algorithms can predict the likelihood of a borrower settling their debt. This allows collectors more info to focus on accounts that are most likely to result in a positive outcome, freeing up valuable resources to critical value engagements.

Furthermore, AI-powered chatbots can deliver 24/7 customer support, answering common queries and directing borrowers through the repayment process. This lowers the workload on human collectors, allowing them to devote on sensitive cases that require a human touch.

The implementation of AI in debt collection is not without its obstacles. Issues such as data protection and the ethical use of AI need to be thoroughly addressed. However, the potential gains are undeniable, and the industry is poised for a transformational shift in the coming years.

Smart Contact Center for Effective Debt Resolution

In today's dynamic financial landscape, credit providers are constantly seeking innovative solutions to enhance debt resolution processes. An AI-powered contact center presents a groundbreaking strategy to achieve this goal. These systems leverage the power of artificial intelligence to accelerate routine tasks, freeing up human agents to focus on more complex and nuanced interactions.

AI-powered chatbots can rapidly handle requests regarding payment options, due dates, and account balances. They can also passively recognize customers who are at risk of defaulting on their payments, allowing for timely interventions. This predictive capability enables lenders to minimize potential losses and improve overall debt recovery rates.

- Additionally, AI-powered contact centers can customize the customer experience by leveraging data analytics to understand individual customer preferences.

- This degree of personalization fosters customer loyalty and contributes to a more effective debt resolution process.

Automated Debt Collection: Precision and Efficiency

Automated debt collection solutions are transforming the industry by delivering unparalleled exactness and effectiveness. These cutting-edge tools leverage intelligent algorithms to target delinquent accounts with greater acumen, ensuring that collection efforts are focused on the most promising cases. By automating routine tasks, such as contacting debtors and arranging payment plans, automated systems release valuable time for debt collectors to devote to more sensitive interactions. This optimized approach not only minimizes operational costs but also boosts the overall recovery percentage of debt recovery efforts.

Elevating Collections Success with AI Solutions

In today's competitive landscape, streamlining collections processes is crucial for financial success. AI solutions are emerging as a game-changer, providing unprecedented capabilities to enhance collections performance. By leveraging machine learning algorithms, AI can assess vast amounts of data to flag high-risk accounts and automate collection workflows. This results in increased recovery rates, reduced write-offs, and a more efficient collections operation.

- Sophisticated analytics can pinpoint patterns and trends that humans might miss, enabling proactive intervention.

- Intelligent systems can handle routine tasks, freeing up valuable time for collectors to focus on complex cases.

- AI-powered chatbots can engage with debtors in a personalized and efficient manner, improving customer satisfaction while driving collections.

By adopting AI solutions, businesses can modernize their collections strategies, achieving sustainable success in a dynamic financial environment.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Kel Mitchell Then & Now!

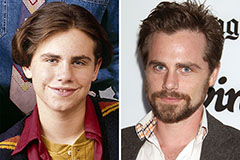

Kel Mitchell Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Michael Bower Then & Now!

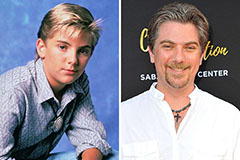

Michael Bower Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now!